Following the Indian Stock Market,Nifty,Sensex and Stocks,by various Technical Analysis Methods for Intraday,Swing and Positional Trading to deploy Personal Finance,Maximize the Profits and Create Wealth.The Blog shares my Nifty Trading Analysis and Trading Strategies. No Tips here.

Saturday, December 31, 2011

Sunday, December 18, 2011

Merry Christmas and a Happy New Year !!!

Christmas is approaching , and as a ritual every year, lot of Traders are expecting a 'Santa' Rally . But instead of hearing Jingle Bells from Santa , I am seeing 'Sunami waves ' on the charts. I fear that Santa (Rally) may not keep it's promise instead we may see 4400 levels approaching soon and probably below .

In the last Post for this Year , let us objectively analyze and check the Technicals for what lies ahead -

Why am I Bearish and why 4400 levels is a high probability Target ?

Labels:

Elliott Wave analysis,

Fibonacci,

FII,

Forex,

Indicators,

nifty chart,

nifty levels,

Option Analysis,

P/E,

Pattern,

Sensex,

Short term,

Stock Markets,

Technical Analysis,

Trendline,

USD V/S INR,

USD$,

Volume Profile

Sunday, December 11, 2011

Sunday, November 27, 2011

Saturday, November 19, 2011

Advisory Service

Thank you All !!! for a positive response and cooperation during the Trial period on Yahoo messenger.

The Trial period ends on 24-11-11.

Advisory Blog -The Trading Journal and Yahoo messenger services will then be open only for the Subscribers.

Subscriptions only for a select batch of Traders will close on 25-11-11.

Mail me for details at aarvee9@gmail.com

Friday, November 11, 2011

Sunday, October 30, 2011

Technical Analysis for Nifty

There has been a Short Term Reversal from recent lows in last couple of weeks. Prices have overcome the Resistances and Gaps to Trade firm. Is it a complete Reversal making the bias Up or is it a Reaction before the Fall follows again ? Let us objectively analyze and try to find a ' Method in the Madness' with help of the Technicals and combination of them -

Labels:

Elliott Wave,

Fibonacci,

FII,

Indicators,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

Option Analysis,

RV,

Sensex,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

Trendline

Tuesday, October 25, 2011

Saturday, October 15, 2011

Elliott Wave Analysis for Nifty

Elliott Wave Analysis helps one understand the prevailingTrend and probable Targets to Trade. Though quite subjective , this theory if used with classical TA methods , is quite handful. It tells the 'Sailor' about the direction of the ' Wind' as well as the distance of the 'Port'.

Lets us now analyze where we are 'sailing' as on date -

Labels:

Elliott Wave,

Elliott Wave analysis,

EW,

Fibonacci,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

Pattern,

RV,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE

Sunday, October 9, 2011

Technical Analysis for Nifty

The above Picture was received in a forwarded mail asking to read the word in this picture. Try doing it. You may be able to read a word in it. Try focusing more ,You will find two words in it , 'Illusion' in Blue landscape and 'Optical' in the Yellow.

Similar is the reading of Charts , we tend to see what we believe. But trading it stubbornly can be harmful for the Capital , instead we try to objectively analyze and get some conclusions that should be traded with Flexibility.

Saturday, October 1, 2011

The Trading Journal

The Link for the Blog used for Advisory Services - The Trading Journal , maintained as a record for the Daily Trading Plans ,Trading Insight , Technical Analysis , Review and Analysis of the Trades executed and Notes for important Lessons learnt in the process is

Sunday, September 25, 2011

Technical Analysis for Nifty

After a big fall in a single session and a followup the next session , we now look for a reaction to it and the probable Resistance levels . The larger Trend is down and almost have confirmed the end of the corrective upmove (of apprx 38%+ ) from the lows of 4720 . Now the larger TF Downtrend takes the driving seat again.

Labels:

Elliott Wave analysis,

Fibonacci,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

Pattern,

RV,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

Volume Profile

Sunday, September 11, 2011

Saturday, September 3, 2011

Sunday, August 28, 2011

Technical Analysis for Nifty

The August series ended with the maximum damage to the Prices in the downfall since Nov ’10 ( from 6338) . The prices corrected from 5700 levels to 4700 levels , apprx. 1000 points fall and now we are trading at multi-months low ( new 52 week low at par with May ’10 levels ). Let us check out the Technical probabilities for the Short Term –

Labels:

Elliott Wave analysis,

FII,

Indicators,

moving average,

nifty,

nifty chart,

nifty levels,

Option Analysis,

Pattern,

RV,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

Trading System,

Volume Profile

Wednesday, August 24, 2011

Update for Trading on 24-08-11

The 15min ORB did not break on downside. Ignore the trade given below.

Tuesday, August 23, 2011

Trading on 24-08-11

Posting a Trade for tomorrow, which may turn out a short term swing if goes right .

Entry : Short the 15 min ORB (opening range breakout ), only if breaks on downside. Take care for the proper break.

S/L : Strictly on ORB high+ 5 points . Put it at once u sell on break.

Postion sizing : Increase below 4890 and hold

Target : May Target 4750-4700 in next two -three trading sessions .

Entry : Short the 15 min ORB (opening range breakout ), only if breaks on downside. Take care for the proper break.

S/L : Strictly on ORB high+ 5 points . Put it at once u sell on break.

Postion sizing : Increase below 4890 and hold

Target : May Target 4750-4700 in next two -three trading sessions .

Caution : Monitor as per intraday charts if goes right. Caution at 4850 ,can be part booked and re enter on its break. Use Trailing s/l and follow.

No Long Trade Recommended .

No Long Trade Recommended .

NOTE : Subscription closes on Friday - 26/08/11.

Thursday, August 18, 2011

Nifty Update & Long Term Target

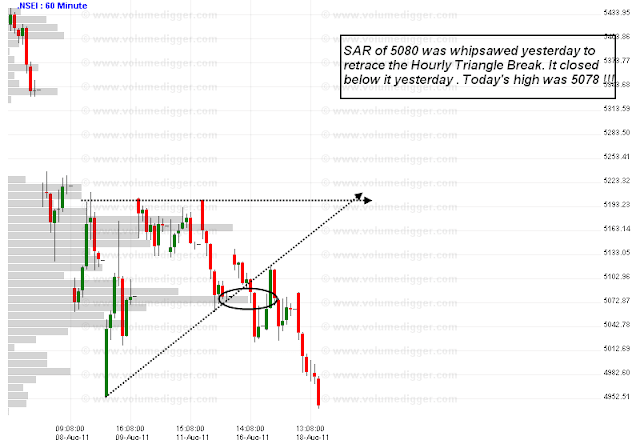

The Hourly Triangle breakdown in the last post , retraced to touch the lower trendline ,whipsawed the SAR of 5080 and closed down below it. Today's high (made in first hour of trade) was 5078 !!! . It was a trending day throughout. Now let us checkout the Weekend Analysis posted on 15-08-11,

" Conclusions:

1. Bias is firmly down in Short term .

2. Watch the Triangle break in Hourly charts for near term direction . ( trigger)

Near term Resistances are 5100 and 5140 apprx. - (The High made this week is apprx 5135)

3. If breaks 5050 or Hourly Triangle down , then can test recent lows . Next move will be on reaction at this level. ( touched the recent low level of 4946 today)

If closes below 5000 levels one can be positionally short with strict s/l . Targets may be 4800 or sub 4800 (as discussed in long term post). Hold & sit tight till Market stops u out. (for Trend Trading).

5. Probability that if the Gap is not filled in next two-three trading sessions or closing above 5200 soon , The Markets may fall by its own weight. " ( Very True !!!)

Long Term Update:

Now the Markets are poised to touch / trade near the Long Term Target of apprx. 4800 level may be tomorrow /soon which I posted at the time of start of the Blog on Jan 30th this year - Click Here and followed up recently - Click Here .

The journey of this duration has been truly Educative and Interactive with positive support from the Readers & fellow Bloggers . Thanks to All !!!

My sincere Thanks also for the warm response given by all to my new venture of Advisory services aimed at 'Learn & Earn'- Click Here

I will be closing the Subscriptions Next Friday , 26-08-11 . Please feel free to Mail me for any queries.

Tuesday, August 16, 2011

Monday, August 15, 2011

Technical Analysis of Nifty for Short Term

Labels:

Elliott Wave,

Fibonacci,

FII,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

Option Analysis,

RV,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

Trendline,

USD$,

Volume Profile

Saturday, August 13, 2011

Friday, August 12, 2011

SGX NIFTY & NIFTY ON 12-08-11

- SGX Nifty closed near the Highs . Nifty may open strong here .

- The first Resistance zone is the 5165-75 zone . If gaps up over it and sustains then may test the 5225-50 zone . Above 5225 apprx is the Gap area upto 5330.

- This seems to be the final leg of the retrace upmove ( which may last a couple of sessions more ) hence Positional traders should start entering with the largerTrend that is Down .

- After the Gap up or strong move , if trades below 5165 ( HVN ) will be bearish.

- Keep 5165 as SAR tmrw. and Trade the chart below.

- Monday is a Trading Holiday so dont take any positions home in the wake of global uncertainity.

Labels:

EW,

Fibonacci,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

RV,

SGX Nifty,

Stock Markets,

Swing Trading,

Technical Analysis,

THE THIRD EYE,

Volume Profile

Thursday, August 11, 2011

SGX NIFTY & NIFTY ON 11-08-2011

SGX Nifty closed in Red. So Nifty here may Gap down. Markets are trying to find foothold above the recent lows and may test 5050-5000 levels.

Fibonacci Retrace levels of the upmove are given in chart , Volume profiles may not work well now due to gap up and downs but 5075 apprx may act as initial support if trades below 5100 , above 5160-65 has emerged as a HVN and will act as a good Resistance , Dont be short above it . Can keep 5100 as SAR and trade the chart tmrw. Though 5000 or 5050 has good chance of holding on closing basis , Below it may well be all Red. Trade very light , cut positions fast till the Market settles in a new range. Better Stay Away.

Tuesday, August 9, 2011

Sunday, August 7, 2011

Friday, August 5, 2011

Thursday, August 4, 2011

Trading Nifty 05-08-11

Nifty has been trading in the Downtrend as expected in line with Weekend analysis Click Here and subsequent updates given below.

Apprx. 5300 levels were expected to reach fast , in day before yesterday's update.

Wednesday, August 3, 2011

Tuesday, August 2, 2011

Trading Nifty 03-08-11

The indication of strength in short term ,trading above 5480 level, mentioned yesterday, was broken in first few minutes of trade and never recovered.

The bias is firmly Down trading below 50dma now.

Monday, August 1, 2011

Update for Nifty Trading 02-08-11

As expected Nifty gave an upmove and was resisted in 5530-5550 zone.

Sunday, July 31, 2011

Technical Analysis for Nifty

Last Weekend Post had these lines as opening statements -

"Nifty is at an important juncture of trading which may decide the short term as well as medium term trend in this week or two. It seems to be coming out of consolidation, now whether it is sustainable or will give a false breakout to sink later is to be seen. "

and this as closing one -

"Bias is towards long now but cautious trading required to avoid getting trapped as indicated. "

Nifty came out of consolidation from the Trading range of apprx. 5740-5500 last week.

It also did give out a false breakout on Monday, giving a 12d high close but sank later below 5500 and 50dma , giving the lowest closing after 25/06/11.

Since the initial Analysis was Bullish last weekend but the above statements were at the hindsight due to various Resistances ahead and expectation of reversal , so the update on Monday eod suggested to keep a SAR of 5635 which came into play right the next day and obliged the whole week further .

Hence always remember the Quote above - " We cannot change the cards we are dealt ,

Just how we play the hand " . It emphasizes preparation , awarness and flexibility that will only help lock in profits and survival in these dynamic markets .

The Technical structure of Nifty has been altered or say reversed compared to last weekend. Now for the analysis of indicators as of today for further trading probabilities-

Labels:

Elliott Wave analysis,

Fibonacci,

moving average,

nifty,

nifty levels,

Nifty Trading System,

Option Analysis,

Pattern,

RV,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

Volume Profile

Saturday, July 30, 2011

Monday, July 25, 2011

Wednesday, July 20, 2011

Tuesday, July 19, 2011

Elliott Wave ,Fibonacci, Moving Averages, Patterns and Nifty

Analyzing the probable Short Term path of Nifty by Elliott Wave Analysis in corelation with Fibonacci levels , Moving averages ,Volume Profile, Patterns and Option analysis.

Sunday, July 17, 2011

Technical Watch for Nifty

Nifty is in consolidating phase as metioned in last weekend post. Nothing much has changed on the broader technicals . The consolidation may continue for this week too, testing and rewarding the patience and discipline or can give a breakout trade one way. Lets check the Technical Insight for this Week .

Thursday, July 14, 2011

Update for Nifty 15-07-2011

As posted in Weekend Post and last Update , we are in a correction within a correction of Higher TF , hence Whipsaws and Test of crucial levels are expected.Today was one such day where the Weekly SAR of 5625 got whipsawed .

Now for Tomorrow's trading one can consider following -

Tuesday, July 12, 2011

Sunday, July 10, 2011

Technical Analysis for Nifty

The coming Trading period for the Next Week (or two) may be quite tricky as the sustained upmove since 5195 slowed down last week ,made a dash to 200dma and corrected down. The next phase will be the Tug of War ,Testing of Levels and Whipsaws.

Labels:

Elliott Wave analysis,

Fibonacci,

FII,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

Option Analysis,

RV,

Short term,

Stats,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

Volume Profile

Perseverance

This beautiful Slideshow was sent to me by Dr. Kumar ( Kumar Tecnicals Blog ). Please view it on full screen and learn the message Nature has to give us. Try it out in your Life and feel the difference .

Saturday, July 9, 2011

Sunday, July 3, 2011

How to Trade Nifty Next Week ?

There has been a consistent Upmove since the recent low of 5195 and Nifty is looking overheated . There may be some cooling down before any move of consequence unfolds . In general, the Next Week may be of a short term correction and consolidation within a range. Let us checkout the Trading Insight and important Levels for trade now .

Sunday, June 26, 2011

Technical Analysis for Nifty

The Markets had a typical short term turnaround in the end of the last week's trading. It catches most retail participants like a rabbit in a torch light ,frozen,surprised and a sense of disbelief . Mature traders having their systems in place are able to cut their wrong positions fast , some even reverse but foremost they save their trading capital and lock in their profits and let the price action decide their decision . Such reversals emphasize the importance of a trading system , sensitivity of it , rules set for trading and discipline to follow it.

"The Secret of winning the Big game is to loose the least amount possible when one is wrong ".

Labels:

Breakout,

Elliott Wave,

Fibonacci,

FII,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

Option Analysis,

RV,

Short term,

Stock Markets,

Swing Trading,

Technical Analysis,

THE THIRD EYE,

Volume Profile

Elliott Wave Analysis for Nifty

Charting the Elliott Wave counts this time seemed to be like watching the Hollywood flick , 'Vantage Point' , where an attempeted assassination of the American President is retold by several different perspectives of the eyewitness , One Truth and so many point of views. What the truth is here , will only be told by the time in future but the counts gave so many Bearish as well as Bullish perspectives that it emphasized the fact that Markets are uncertain and only prediction which will hold true is that -

"The Markets are Unpredictable".

Labels:

Elliott Wave analysis,

EW,

Fibonacci,

Long Term,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

RV,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

trade method,

Trading

Tuesday, June 21, 2011

Interesting Charts - Nifty

Trading is a Business of managing uncertainities. If there was a certainity in the Maket ,it will cease to exist . Acceptance of uncertainity is a virtue and reacting to it is the way to trade . We all trade our beliefs in the arena and have no control over the markets , but importantly we can control our actions and be hedged against our own beliefs . The most difficult part of trading is to manage oneself in realtime , trade the screen , control the risk and leave the bias when price action says it to . All this can only come if the rules of the trading system are set in place and above all are followed with discipline. Let no loss go without a lesson and be able to shake the confidence .Probabilities have to be traded but with proper risk management. Easier said than done, but that is why only a few succeed here.

You Cannot Change The Direction of the Wind , But You Can Adjust Your Sails !!!

Sunday, June 19, 2011

Tuesday, June 14, 2011

Nifty : Astrology , Lunar Cycle, Time Cycle, Eclipse, Elliott Wave and Crash Ahead ???

Recently I have been reading about the coming Lunar Eclipse and tried to research about its effect on Stock Markets . This Post is compilation of resources from the Net covering the various aspects of Astrology , Lunar Cycles, Time Cycles , Lunar Eclipse etc . For me the topics are more of Paranormal Activities due to lack of my knowledge and understanding the same but of great interest too.

Sunday, June 12, 2011

Technical Analysis for Nifty

Friday, June 10, 2011

Jan LokPal Bill - Text & Analysis

For the first time in the 63 year history of our nation, the citizens have the opportunity to directly participate in the making of a law that will have significant and direct impact on their lives and the life of the nation. The country is today ridden by corruption. Whether it be routine transactions that involve the government or services and amenities and benefits provided through the public exchequer, the ordinary citizen pays a price daily in terms of harassment, delays, poor quality, absent infrastructure and in-equal access. What we need is an effective and independent institutional mechanism for tackling the malaise of corruption in this country. That institution is the Jan Lokpal.

Labels:

bill,

Cause,

Corruption,

Govenment,

India,

Jan Lokpal,

Life,

Lokpal,

Movement,

People,

RV,

Support,

THE THIRD EYE

Subscribe to:

Posts (Atom)