AARVEE had explained and pointed out this during intraday [refer http://o-j-n.blogspot.com/2010/10/chart-update.html] the use of 13ema 34ema on the 5min Yahoo chart. [The chart is available at the bottom of the posts in this blog live on refresh]This is an addon to explain it.alphabet1's additions:

1. Target 20 to 40 point max to begin.

2. Get out of trade in half hour in case nifty do not move as anticipated.

3. This is best used when confluence happens on key Support or Resistance levels.

3a. Target is the next key level with SL mid point of the level in reverse (if you are long at R1 then Tgt is R2 and SL is mid point between R1 and Pivot / S1)

4. once breach 34 ema hold position till the time 3 ema is not breached.

4a. May add position on bounce of 13 ema.

4b. In practice, once meets target of R2 and holds there , move up SL and revise Tgt for R3.

5. use STS and RSI to see overbought and Oversold scenario is in sync with the ema confluence.

IF NOT DO NOT ENTER TRADE.

sujatha's input:

for short term we can book out @ 34 ema..this is working out very well.

Apart from technicals, one need "good knowledge and observation" of markets. Example - Most expected upside yesterday as per TA but didn't touch, Observation of "price behaviour" is important according to me. It doesn't mean TA is not good. :) that is a precautionary step for trading, once "market opens" all will change.

i will book 50% @ 34 ema without any secondary thought. (intra) My policy is "day trader" should not wait for the "exact target" whenever it comes book profit once and "trail the sl" then book @ swing (if know the swing level) 3rd part is positional.

aarvee adds:

1.I take only 13 and 34 ema as 3 ema gives lots of whips.and its obvious that in a 5 min TF use of 3will not be very fruitful.

2.Take only one trade in a day.Intra gives both sided pure opportunites only few days a month.

3.emas though are lagging but are safe ,wait for one candle to get below the bearish/bullish cross for added safety.

4.s/l should be put as per risk appetite but should be practical to give breathing space to the trade.

5.Indicators should not be much of a concern in 5min TF (on friday also u can see that trade on short side developed in oversold region of stochs.)

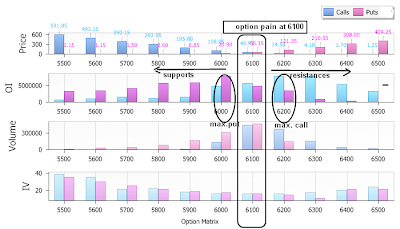

6.Profit booking should be done on the next target /pivot,we had 6050 in mind below 6090 from premkt.)

7.also note that 6114 was mentioned by sujatha and 6105 by vol. profile as imp. resistance.look for the confluence area below/above it and wait for signal to trade.Mkt gives time and tug there for enough time to enter as the level is imp. for both sides in a sideways mkt.

8.target should also be defined by the range of nifty or say the ATR.I have found half of the range as a realistic target and remaining half gives the trade signals and whipsaws.

Normally i find only a single onesided trade that if enetred well will do the needful in an hour.i.e both entry and exit.rest of the time is watching signals and general tug of war not reqd. to be read into.

9. Possible trade should be with the trend and if the trend is sideways (as is since few weeks)trade should be light and nimble.

10. There will always be loosing trades .If fast enough to reverse a loosing trade then ok or else one should get stopped, sit out and enjoy.