UPDATE 17-03-2011 :

1. Traded on both sides of the SAR of 5500 today and gave a good short trade to target 5440 .

2. Some signs of weakness emerging with FII net sell figure of 1100cr+ today , reduction of 5400 Puts O.I. along with aggresive addition of 5500 Calls and 2day & 5day Volume Profiles showing weakness below 5510 levels now.

3. Same levels are to be traded again tomorrow-

-Pivot of 5450/Today's close along with 15min ORB can be used initially for tomorrow's trade.

-SAR at 5500/10 ,Cautious long above it ,aggresive longs above 5540.

-Cautious short below SAR and aggresive ones below 5440/35.

-Book out fast .

-Open positions for next week only on close above 5560 or below 5400.

4. The directionless trading requires patience ,caution and risk management.One should trade levels for small profits /loss till the range resolves.

-----------------------------------------------------------------------------------------------------

UPDATE 16-03-2011:

Today's Trade and close has resemblance to Monday's trade.

1. Tomorrow's trade may be influenced by the RBI's monetary Policy Review and decision on Interest Rate Hike.

2. Keep the SAR as 5500. Target above is apprx. 5550 , 5580 ,5625. Below is 5480 ,5440 and below.One may get to trade on both sides of the SAR.

3. Cautious Long above 5500 and trading above 5540 . Positional Short only below Yesterday's low of 5370 , caution signal for weakness is break of 5440 level.

Trade light and nimble. Markets are still not out of the woods, searching direction,caution is the key.

---------------------------------------------------------------------------------------------------------

UPDATE 15-03-2011:

1. Today was a big Gap down day inspite of all the Bullish sentiments in the short term brought by Monday's trade. The last close price was above all critical Ema's & Volume profile high nodes in short term TF, Bullish engulfing candle, Breakout of pattern, FII net positive figures, Bullish option data etc. All this was washed in the after effects of the Japanese 'Tsunami'.

Trading is a Business of managing Uncertainity.

2. Though as of EOD , it did little damage to the Market structure in short term , appears insignificant in Daily charts and was resolved in the very first hour of trade by closing above 5400 levels in Hourly charts , it leaves behind an important lesson. The lesson is of Discipline , Money management, Caution . It has more to do with self management of trade than fine tuning the trading system .It also emphasizes uncertainity of Markets and inherent risk involved in leveraged trades.

Caution was suggested yesterday for breakout on low volumes and in last week's review to trade light in contra trades against the larger TF down trend.

Discipline is the best tool to manage uncertainity and is anyday better than conviction.

3. Today was the test of - Markets will do what they have to do , Its our action and emotion in response to it that will decide the balance in the trading a/c. The only aspect that we can control in trading is our actions.

The big secret of Winning is to lose the least when you go wrong and moreover it is not about being right or wrong but how much u make when u r right and how much u lose when ur wrong

4. FII and DII were both net buyers today ,was it more of a shakeoff ? a whipsaw below 5400? In fact they both have been net buyers in the March series till date.

5. 2Day,5D,10D Volume Profiles are concurring to give the High volume node of apprx. 5500. One may keep this as SAR going further.

6. Option data still suggests support at 5400 level ,though there has been a fall in O.I. at 5400 Puts but still no significant buildup at 5500 or for that matter at even 5600 Calls is seen.

Break of 5400 has twice given apprx. 200 points in Feb .The accumulation suggests that same may happen again , if does not finds support at today's low of apprx. 5370.

7. Today's VWAP is at 5440 NF apprx. ,one should be cautious below it and go short below today's low with strict S/L .Cautiously one should wait for filling up of today's gap area and go long only above high of 5540 level.

8. As suggested before, Trade light and nimble till trend in short term breaks with volumes and gives direction.

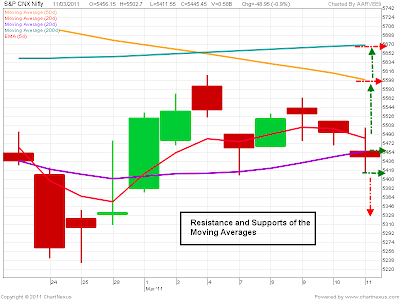

Incidentally ,check the Image posted above with this Weekend Post. It says all.

-----------------------------------------------------------------------------------------------------------

UPDATE 14-03-2011:

Prices have broken out of the Pattern mentioned in the charts below. The next targets on upside is 5580 ,5625 & 5670 levels.

The SAR should be the 5480 level again as per the Volume profiles and Important EMA no's. today. Strictly adhere to it for caution against a false breakout as today's upmove was on comparitive low volumes.

5400 Puts have again accumulated one cr. + open interest. (Remember similar O.I. was broken twice in Feb. series , last on the feb. series expiry day). Looks like it will provide support this time.

Please go through the Market insight discussed in detail in the Post last week ( Click Here ) and Charts below .

---------------------------------------------------------------------------------------------------------

The Market structure has not changed much since the last week. I am only posting some self explainatory Charts to fine tune the Weekly startegy for this Week .

1. Bollinger Bands :

2. Volume Profiles :

5day Profile-

10day Profile-

3. Moving Averages :

4. Trendlines :

5. Pattern :

6. Fibonacci Count:

7. Option Data :

8. Elliot Wave Counts :

Please go through the Post - Short-Term-EW for the probabilities. ( Dont forget the Dark Horse Count )

This Week's Strategy will broadly remain same as the Last Week's . Please fine tune some levels as per the Charts above.

7 comments:

one gapdown is enough to spoil patterns

Ya Anonymous ,

Thanks for reminding.

hi rv ..5400 taken..

:)

still not impulsive

Hi manu,

Not seeing it with EW angle.

as mentioned will carry shorts below 5400 close.

for intraday ,one has to watch for positive diversions and bullish cross of 13-34 ema if happens on 5min charts. s/l for shorts 5450 .also it is the SAR now

thnx..

Deaqr Rajeev,

Happy Holi to U and all ur Blogmates.

Thanks & Regards

Sanjay

Dear Sanjay,

Thanks,

I wish u and ur team the same.

HAPPY HOLI!!!!!!

Post a Comment