Following the Indian Stock Market,Nifty,Sensex and Stocks,by various Technical Analysis Methods for Intraday,Swing and Positional Trading to deploy Personal Finance,Maximize the Profits and Create Wealth.The Blog shares my Nifty Trading Analysis and Trading Strategies. No Tips here.

Sunday, April 29, 2012

Saturday, April 28, 2012

Friday, April 27, 2012

Sunday, April 22, 2012

Technical Analysis for Nifty

For the whole Month of April till now the range of Nifty is just apprx. 200 points even with important events as Results and RBI policy etc gone by . It may be making most traders uncomfortable as this sideways , low range and low volume Market tends to whipsaws all trading systems. Below are some charts with observations.

Saturday, April 21, 2012

Wednesday, April 18, 2012

Tuesday, April 17, 2012

Tweets for Nifty Trading

RBI policy was announced today and setup posted yesterday gave a good trade on long side . Below are few Tweets done as observation in the runup to the RBI event .

13-04-12 :

16-04-12

Hope they helped !!!

Join me on Twitter for Post Updates and Lot more -

Monday, April 16, 2012

Sunday, April 15, 2012

Saturday, April 14, 2012

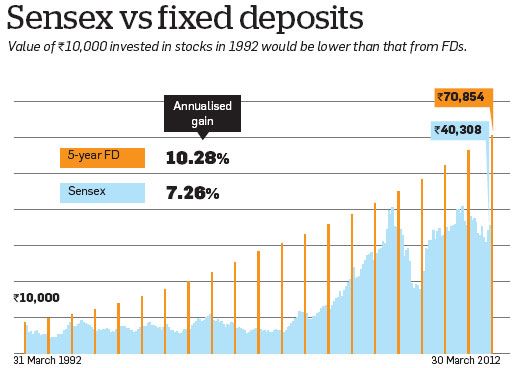

FD beats Equity Investment !!!

An article in ET suggests that for a time period of last 20 years Stock Markets have underperformed Fixed Deposits. The article is an eye opener for Long Term investing and underlines the need for Timing and Active portfolio management for Investors.

Check the article at - The Economic Times

Friday, April 13, 2012

Follow me on Twitter for Nifty Watch

Follow me on Twitter for Auto update of Posts and Lots more !!!

Monday -09-04-12:

Chart updated with observations . Open was below SAR 5320 and now may be in last leg of ST correction . 5195-5225 is a low risk zone for longs which will be counter trend as of now (look for reversal signals in lower TF ) so caution for position sizing and stoploss.

Wednesday - 11-04-12 :

Nifty Watch :

Tuesday, April 10, 2012

Monday, April 9, 2012

Nifty Trading

Chart updated with observations . Open was below SAR 5320 and now may be in last leg of ST correction . 5195-5225 is a low risk zone for longs which will be counter trend as of now (look for reversal signals in lower TF ) so caution for position sizing and stoploss. ST bias is down now.

A probability of this being the A leg since 5378 (in a-b-c subwaves ) and correction further extending after doing a B up remains . Close above Down Trendline confirms the end of correction.

Any break of lower trendline which will also break the 200dma has further bearish consequences.

Nifty closes below Daily S3

When Nifty index closes below Support level 3 on Monday

Courtesy : Stocksiq

Sunday, April 8, 2012

Resource for Hindi Songs

Check out this Web site having extensive collection of Hindi Songs with search by Singer , Movie, Musician , Lyricist , Actor , Category , Year wise , Alphabetically ( for Movie Title and Singer ). You can also view Video For each song along with the lyrics too !!!

http://www.hindigeetmala.com/

When Nifty rises by more than 10% in a Quarter -

With Nifty index gaining 14.52% in Jan-mar 2012 quarter , look at how how Nifty index fares in the next quarter, below are the 10% rises that we had in a quarter since 2000 on the Nifty index , along with the details of how the S&P CNX Nifty index performed next quarter. As shown, Nifty gained 11/17 times with an average gain ( including the loosing months) of 6.53% next month , and a median gain of 6.66%. The maximum loss was -22.87% ( in Mar 2008 )

Courtsey : Stocksiq

Subscribe to:

Posts (Atom)