The August series ended with the maximum damage to the Prices in the downfall since Nov ’10 ( from 6338) . The prices corrected from 5700 levels to 4700 levels , apprx. 1000 points fall and now we are trading at multi-months low ( new 52 week low at par with May ’10 levels ). Let us check out the Technical probabilities for the Short Term –

Following the Indian Stock Market,Nifty,Sensex and Stocks,by various Technical Analysis Methods for Intraday,Swing and Positional Trading to deploy Personal Finance,Maximize the Profits and Create Wealth.The Blog shares my Nifty Trading Analysis and Trading Strategies. No Tips here.

Sunday, August 28, 2011

Wednesday, August 24, 2011

Update for Trading on 24-08-11

The 15min ORB did not break on downside. Ignore the trade given below.

Tuesday, August 23, 2011

Trading on 24-08-11

Posting a Trade for tomorrow, which may turn out a short term swing if goes right .

Entry : Short the 15 min ORB (opening range breakout ), only if breaks on downside. Take care for the proper break.

S/L : Strictly on ORB high+ 5 points . Put it at once u sell on break.

Postion sizing : Increase below 4890 and hold

Target : May Target 4750-4700 in next two -three trading sessions .

Entry : Short the 15 min ORB (opening range breakout ), only if breaks on downside. Take care for the proper break.

S/L : Strictly on ORB high+ 5 points . Put it at once u sell on break.

Postion sizing : Increase below 4890 and hold

Target : May Target 4750-4700 in next two -three trading sessions .

Caution : Monitor as per intraday charts if goes right. Caution at 4850 ,can be part booked and re enter on its break. Use Trailing s/l and follow.

No Long Trade Recommended .

No Long Trade Recommended .

NOTE : Subscription closes on Friday - 26/08/11.

Thursday, August 18, 2011

Nifty Update & Long Term Target

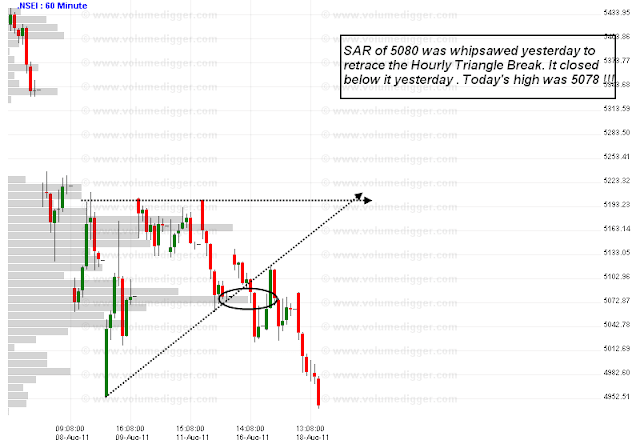

The Hourly Triangle breakdown in the last post , retraced to touch the lower trendline ,whipsawed the SAR of 5080 and closed down below it. Today's high (made in first hour of trade) was 5078 !!! . It was a trending day throughout. Now let us checkout the Weekend Analysis posted on 15-08-11,

" Conclusions:

1. Bias is firmly down in Short term .

2. Watch the Triangle break in Hourly charts for near term direction . ( trigger)

Near term Resistances are 5100 and 5140 apprx. - (The High made this week is apprx 5135)

3. If breaks 5050 or Hourly Triangle down , then can test recent lows . Next move will be on reaction at this level. ( touched the recent low level of 4946 today)

If closes below 5000 levels one can be positionally short with strict s/l . Targets may be 4800 or sub 4800 (as discussed in long term post). Hold & sit tight till Market stops u out. (for Trend Trading).

5. Probability that if the Gap is not filled in next two-three trading sessions or closing above 5200 soon , The Markets may fall by its own weight. " ( Very True !!!)

Long Term Update:

Now the Markets are poised to touch / trade near the Long Term Target of apprx. 4800 level may be tomorrow /soon which I posted at the time of start of the Blog on Jan 30th this year - Click Here and followed up recently - Click Here .

The journey of this duration has been truly Educative and Interactive with positive support from the Readers & fellow Bloggers . Thanks to All !!!

My sincere Thanks also for the warm response given by all to my new venture of Advisory services aimed at 'Learn & Earn'- Click Here

I will be closing the Subscriptions Next Friday , 26-08-11 . Please feel free to Mail me for any queries.

Tuesday, August 16, 2011

Monday, August 15, 2011

Technical Analysis of Nifty for Short Term

Labels:

Elliott Wave,

Fibonacci,

FII,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

Option Analysis,

RV,

Short term,

Stock Markets,

Technical Analysis,

THE THIRD EYE,

Trendline,

USD$,

Volume Profile

Saturday, August 13, 2011

Friday, August 12, 2011

SGX NIFTY & NIFTY ON 12-08-11

- SGX Nifty closed near the Highs . Nifty may open strong here .

- The first Resistance zone is the 5165-75 zone . If gaps up over it and sustains then may test the 5225-50 zone . Above 5225 apprx is the Gap area upto 5330.

- This seems to be the final leg of the retrace upmove ( which may last a couple of sessions more ) hence Positional traders should start entering with the largerTrend that is Down .

- After the Gap up or strong move , if trades below 5165 ( HVN ) will be bearish.

- Keep 5165 as SAR tmrw. and Trade the chart below.

- Monday is a Trading Holiday so dont take any positions home in the wake of global uncertainity.

Labels:

EW,

Fibonacci,

moving average,

nifty,

nifty chart,

nifty levels,

Nifty Trading System,

RV,

SGX Nifty,

Stock Markets,

Swing Trading,

Technical Analysis,

THE THIRD EYE,

Volume Profile

Thursday, August 11, 2011

SGX NIFTY & NIFTY ON 11-08-2011

SGX Nifty closed in Red. So Nifty here may Gap down. Markets are trying to find foothold above the recent lows and may test 5050-5000 levels.

Fibonacci Retrace levels of the upmove are given in chart , Volume profiles may not work well now due to gap up and downs but 5075 apprx may act as initial support if trades below 5100 , above 5160-65 has emerged as a HVN and will act as a good Resistance , Dont be short above it . Can keep 5100 as SAR and trade the chart tmrw. Though 5000 or 5050 has good chance of holding on closing basis , Below it may well be all Red. Trade very light , cut positions fast till the Market settles in a new range. Better Stay Away.

Tuesday, August 9, 2011

Sunday, August 7, 2011

Friday, August 5, 2011

Thursday, August 4, 2011

Trading Nifty 05-08-11

Nifty has been trading in the Downtrend as expected in line with Weekend analysis Click Here and subsequent updates given below.

Apprx. 5300 levels were expected to reach fast , in day before yesterday's update.

Wednesday, August 3, 2011

Tuesday, August 2, 2011

Trading Nifty 03-08-11

The indication of strength in short term ,trading above 5480 level, mentioned yesterday, was broken in first few minutes of trade and never recovered.

The bias is firmly Down trading below 50dma now.

Monday, August 1, 2011

Update for Nifty Trading 02-08-11

As expected Nifty gave an upmove and was resisted in 5530-5550 zone.

Subscribe to:

Posts (Atom)