Following the Indian Stock Market,Nifty,Sensex and Stocks,by various Technical Analysis Methods for Intraday,Swing and Positional Trading to deploy Personal Finance,Maximize the Profits and Create Wealth.The Blog shares my Nifty Trading Analysis and Trading Strategies. No Tips here.

Wednesday, August 25, 2010

EOD

EW update 3

The subminutte count invalidated as iv subminutte breached the top of the ist ,breaking the hard rule.

Again to the surfing board to relabel waves

Again to the surfing board to relabel waves

EW update 2

EW count

This probable EW count is for academic interest only.

Labeling

Intermediate Wave- starts from the upmove of 4786

Minor wave-‘5th’ of the above (shown in daily chart)

Minute wave- ‘iv’ th of the 5th minor (shown in daily chart)

Minutte wave- ‘c’ wave of the ivth Minute of the 5th Minor ( started day before yesterday in 5 wave move down, 4th Subminutte of this completed)

Inferences:

-‘5’ th Subminutte of the ‘c ’ Minutte of the ‘ iv’ th Minute of the ‘5th’ Minor to start.

Can go down below yesterday’s low. This ‘iv’th Minute should not go below 5452 ,as per hard EWrules.

-A positive diversion may develop near the end of this ‘iv’th Minute wave.

-Trendline break of the ‘c’ of 'iv' th down ,will start the ‘vth’ of the ‘5th’.It can end truncated or go on to make a new high.

Corelations

-As per Market Profile we know that 5465 area is a high volume zone,providing good support .So the ivth Minute may end near here.

-FII’s have been buying relentlessly ,The vth of the 5th minor may end making a new high sometime in the Sept .series.

-Option analysis of Aug. suggests a expiry above 5500 and below 5600.so the ivth Minute may end near 5465 and vth minute’s ,subminutte waves can take it to the above zone.

Labeling

Intermediate Wave- starts from the upmove of 4786

Minor wave-‘5th’ of the above (shown in daily chart)

Minute wave- ‘iv’ th of the 5th minor (shown in daily chart)

Minutte wave- ‘c’ wave of the ivth Minute of the 5th Minor ( started day before yesterday in 5 wave move down, 4th Subminutte of this completed)

Inferences:

-‘5’ th Subminutte of the ‘c ’ Minutte of the ‘ iv’ th Minute of the ‘5th’ Minor to start.

Can go down below yesterday’s low. This ‘iv’th Minute should not go below 5452 ,as per hard EWrules.

-A positive diversion may develop near the end of this ‘iv’th Minute wave.

-Trendline break of the ‘c’ of 'iv' th down ,will start the ‘vth’ of the ‘5th’.It can end truncated or go on to make a new high.

Corelations

-As per Market Profile we know that 5465 area is a high volume zone,providing good support .So the ivth Minute may end near here.

-FII’s have been buying relentlessly ,The vth of the 5th minor may end making a new high sometime in the Sept .series.

-Option analysis of Aug. suggests a expiry above 5500 and below 5600.so the ivth Minute may end near 5465 and vth minute’s ,subminutte waves can take it to the above zone.

Tuesday, August 24, 2010

Monday, August 23, 2010

EOD

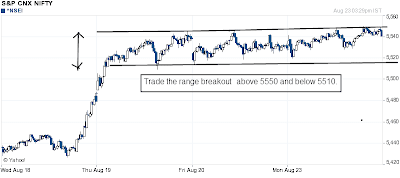

Range bound trading from last three days.Keep an eye on the range break.

Volume profile of last three days shows 5530 as important pivot

Volume profile of last three days shows 5530 as important pivot

Sunday, August 22, 2010

Weekend Analysis

Indicators:

The short term indicators are in overbought region with no signs of reversal.This may keep the trend up till Aug. series expiry.

Volume Profile:

The 10d chart shows good support at 5460 levels .If Nifty trades near this levels in next couple of days ,it may be bought till expiry.

Pattern:

The Channel movement that Nifty is trading since Oct '09 may offer Resistance at top trendline near 5600 levels.

Option analysis:

Max. buildup of O.I. in Calls is at 5600 strike (capping upside) and that in Puts is at 5300 with approx. equal O.I. at 5400 strike (capping downside). 5500 put is adding O.I. consistently and is more than that at 5500 call strike (bullish).

Probabale Aug series expiry should be above 5460 levels and may be above 5500 levels but below 5600 mark.

Note:The probable EW count of the upmove since 4786, may have mistakes .Pl. comment to correct it.

The short term indicators are in overbought region with no signs of reversal.This may keep the trend up till Aug. series expiry.

Volume Profile:

The 10d chart shows good support at 5460 levels .If Nifty trades near this levels in next couple of days ,it may be bought till expiry.

Pattern:

The Channel movement that Nifty is trading since Oct '09 may offer Resistance at top trendline near 5600 levels.

Option analysis:

Max. buildup of O.I. in Calls is at 5600 strike (capping upside) and that in Puts is at 5300 with approx. equal O.I. at 5400 strike (capping downside). 5500 put is adding O.I. consistently and is more than that at 5500 call strike (bullish).

Probabale Aug series expiry should be above 5460 levels and may be above 5500 levels but below 5600 mark.

Note:The probable EW count of the upmove since 4786, may have mistakes .Pl. comment to correct it.

Wednesday, August 18, 2010

EOD

This was the second close above the important level of 5475 .

Positional shorts will be quit tommorow on convincing trade above 5492,the recent high

Intraday long to be traded above new high with light positions.

Such is the trading torture since last one month.!!!!

![MySpace Graphics]()

Positional shorts will be quit tommorow on convincing trade above 5492,the recent high

Intraday long to be traded above new high with light positions.

Such is the trading torture since last one month.!!!!

Tuesday, August 17, 2010

Monday, August 16, 2010

EOD

Positional Trade on the shorter side was carried precisely for the reason market showed today.It failed to go over the High Volume area of 5465 and has now broken the 10 d high volume area of 5440.This level now has more importance as it has become the Weekly Pivot too.We will keep it as SAR for this week also as done in last. Expect support at 5350.

Checkout today's and 10d chart

A word of caution : Hidden positive divergence is seen in the 5day chart .Keep an eye on it untill resolved.

Checkout today's and 10d chart

A word of caution : Hidden positive divergence is seen in the 5day chart .Keep an eye on it untill resolved.

Friday, August 13, 2010

EOD

Intraday Update:

Shorts taken at Weekly pivot and 5day highema proved to be a dud. The negative diversion in the chart ended what looked like a perfect uptrending day and helped cover the shorts almost at par.

The trade taken was wrong as it was against the trend as well as neglected the important SAR of 5440 ,the crossing of which should have been a long trade .

Carrying the positional shorts though the aggresive s/l of close above 5440 has been hit but taking chances with the close above conservative s/l i.e 5485 .

Still the question remains that this closing above 5440 (Mon,Tues,Fri) is a trap or that happened below it (Wed,Thrus) was a trap? (Today's Option Analysis pointing to bullish possibilities.)

Have a Great Weekend and HAPPY INDEPENDENCE DAY !!!

Shorts taken at Weekly pivot and 5day highema proved to be a dud. The negative diversion in the chart ended what looked like a perfect uptrending day and helped cover the shorts almost at par.

The trade taken was wrong as it was against the trend as well as neglected the important SAR of 5440 ,the crossing of which should have been a long trade .

Carrying the positional shorts though the aggresive s/l of close above 5440 has been hit but taking chances with the close above conservative s/l i.e 5485 .

Still the question remains that this closing above 5440 (Mon,Tues,Fri) is a trap or that happened below it (Wed,Thrus) was a trap? (Today's Option Analysis pointing to bullish possibilities.)

Have a Great Weekend and HAPPY INDEPENDENCE DAY !!!

Thursday, August 12, 2010

EOD

Intra day Update:

Yesterday's EOD showed oversold short term time frames , Dow coupled with close below 5d low ema gave the gap down opening.Morning tweet at opening was biased for long with 5420 levels as resistance .Markets obliged (with cool 50 points.)

The charts now show Resistance at 5435-5445 levels.

Break of 5390 signalling early sign of weakness.

5350 level remains the important Support.

Yesterday's EOD showed oversold short term time frames , Dow coupled with close below 5d low ema gave the gap down opening.Morning tweet at opening was biased for long with 5420 levels as resistance .Markets obliged (with cool 50 points.)

The charts now show Resistance at 5435-5445 levels.

Break of 5390 signalling early sign of weakness.

5350 level remains the important Support.

Wednesday, August 11, 2010

Tomorrow's Trade

Pl. see the 5min, 15min ,30min,60min charts.The short term indicators are in oversold conditions in all of them whereas in Daily charts they are in sell mode.As today's close is below 5d low ema for first time in last many days and oversold indicators may prompt a retest of 5d close ema at 5445 ,but the Daily TA in sell mode may take back the movement downwards.Prices have closed near 20dema today and July expiry (of Aug.series futures) at 5421 .

So, any bounce to the mentioned level of 5445 or higher can be used for short buildup.Remember that 5440 was also a good support that was broken today so will act as a resistance further till overcome.

The bias is down now till closes above approx 5475 levels again for Positional trade.Target 5350-5320 levels based on Bollinger band and Fibo. retrace levels in Daily charts.

So, any bounce to the mentioned level of 5445 or higher can be used for short buildup.Remember that 5440 was also a good support that was broken today so will act as a resistance further till overcome.

The bias is down now till closes above approx 5475 levels again for Positional trade.Target 5350-5320 levels based on Bollinger band and Fibo. retrace levels in Daily charts.

EOD

INTRADAY UPDATE:

The long position taken at 5440 was promptly discarded by markets and s/l below 5440 was hit after an hr.Today was an allout downtrend day.

As the Positional trade s/l of closing above 5475 was hit on Monday,5440 level was treated as SAR since,the break of 5440 triggered the SAR today.

It is to be seen that the trade of closing above 5475 was a whipsaw or this trade taken at close below 5440 proves to be a whipsaw in shortterm. Initial Target is 5350 now and 5440 to be treated as SAR.

The long position taken at 5440 was promptly discarded by markets and s/l below 5440 was hit after an hr.Today was an allout downtrend day.

As the Positional trade s/l of closing above 5475 was hit on Monday,5440 level was treated as SAR since,the break of 5440 triggered the SAR today.

It is to be seen that the trade of closing above 5475 was a whipsaw or this trade taken at close below 5440 proves to be a whipsaw in shortterm. Initial Target is 5350 now and 5440 to be treated as SAR.

Tuesday, August 10, 2010

Monday, August 9, 2010

The Bear Takes a Rest

The Stoploss of the Positional trade(taken in mid July), at 5475 on closing basis ,has been hit today.

The Option Analysis does not shows any panic in call writers and they are even adding at 5500 strike ,similarly though the puts at 5400 have added but not in big quantity so as to emphasize a big rally coming up.

The Bear takes a rest but due to O/B and negative diversion persistance in charts ,it will remain vigilant at the break of 5450/40 levels .

Till then trade light and with the Trend, that's UP.

Sunday, August 8, 2010

Weekend Analysis

1. 5 Day charts:

It shows the weakening movement.Though a small bounce can be expected early tomorrow.

2. Daily chart:

The Rising wedge pattern on breakdown changed to range bound channel trading.lookout for break of the channel as indicators are either O/B or in sell mode,with negative diversions.

3. Weekly chart:

The Weekly movement is in a channel sice last four weeks.Check for the break of the range at 5480-5350 for positional trade.The indicators are in O/B mode with negative diversions.

4.Option Analysis:

The accumulation of 5400 calls and reduction in 5400 & 5300 puts emphasize weakening of prices and some downside.

5.Other Indicators:

The PE ratio has reached its resistance near 23 levels and the VIX is also trading near lows and forming a bottom.They both indicate nearness of an intermediate top.

It shows the weakening movement.Though a small bounce can be expected early tomorrow.

2. Daily chart:

The Rising wedge pattern on breakdown changed to range bound channel trading.lookout for break of the channel as indicators are either O/B or in sell mode,with negative diversions.

3. Weekly chart:

The Weekly movement is in a channel sice last four weeks.Check for the break of the range at 5480-5350 for positional trade.The indicators are in O/B mode with negative diversions.

4.Option Analysis:

The accumulation of 5400 calls and reduction in 5400 & 5300 puts emphasize weakening of prices and some downside.

5.Other Indicators:

The PE ratio has reached its resistance near 23 levels and the VIX is also trading near lows and forming a bottom.They both indicate nearness of an intermediate top.

Subscribe to:

Comments (Atom)