Dear Sujatha ,the ace intraday trader ,multitasking with housewife chores, made an important observation about USD V/S INR and its effect on Nifty/Sensex.

Though I dont actively follow this corelation ,here are few observations-

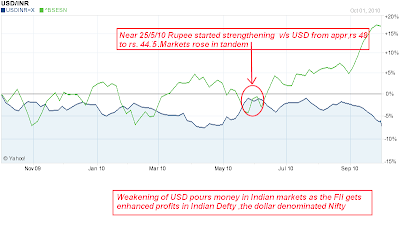

1. INR has been going strength to strength v/s USD since May 2010 and so are the Indian markets.

2. Nifty made a intermediate low of 4800 levels near May '10 end ,when the Rupee was it's weakest against USD in medium term.

3. FII's have poured money like no tomorrow since then ,because of the superior returns they get in dollar terms here in Indian Defty Index.

What is “S&P CNX Defty”? -

“Almost every institutional investor and off-shore fund enterprise with an equity exposure in India would like to have an instrument for measuring returns on their equity investment in dollar terms. To facilitate this, a new index the S&P CNX Defty-Dollar Denominated S&P CNX Nifty has been developed. S&P CNX Defty is S&P CNX Nifty, measured in dollars.”---NSE.

The Defty is a Performance indicator to foreign institutional investors, off-shore funds, etc and also it Provides an effective tool for hedging Indian equity exposure.

Now lets us check the Defty returns compared to Nifty since 25/05/10 till date.

NIFTY - 6153 - 4786 = 1367 points or 28 %

DEFTY- 4783 - 3478 = 1305 points or 37 % returns ,

that is clear 9-10% more ,hence the massive influx of dollars.

4. Now the INR is critically poised against USD at historical support .This relation should now be carefully watched , it's unfolding will signal the movement of Indian markets going ahead.

Thanks Sujatha !!

Though I dont actively follow this corelation ,here are few observations-

1. INR has been going strength to strength v/s USD since May 2010 and so are the Indian markets.

2. Nifty made a intermediate low of 4800 levels near May '10 end ,when the Rupee was it's weakest against USD in medium term.

3. FII's have poured money like no tomorrow since then ,because of the superior returns they get in dollar terms here in Indian Defty Index.

What is “S&P CNX Defty”? -

“Almost every institutional investor and off-shore fund enterprise with an equity exposure in India would like to have an instrument for measuring returns on their equity investment in dollar terms. To facilitate this, a new index the S&P CNX Defty-Dollar Denominated S&P CNX Nifty has been developed. S&P CNX Defty is S&P CNX Nifty, measured in dollars.”---NSE.

The Defty is a Performance indicator to foreign institutional investors, off-shore funds, etc and also it Provides an effective tool for hedging Indian equity exposure.

Now lets us check the Defty returns compared to Nifty since 25/05/10 till date.

NIFTY - 6153 - 4786 = 1367 points or 28 %

DEFTY- 4783 - 3478 = 1305 points or 37 % returns ,

that is clear 9-10% more ,hence the massive influx of dollars.

4. Now the INR is critically poised against USD at historical support .This relation should now be carefully watched , it's unfolding will signal the movement of Indian markets going ahead.

Thanks Sujatha !!

5 comments:

RV,

Defty has yielded more this season.

Thanks a ton Aarvee,

Very scary charts. See, keeping in "memory and doing by observation" is different and i will do my "routine" work with thinking of this levels and come to a conclusion and type that to you.

But presenting in a technical chart is very difficult, you have done a excellent job and now I have to be very cautious as if not taking reversal then sure as you mentioned "nifty will show rally" upto "EARLY NEXT YEAR".

Thanks RV

Reading your posts is like taking a dip in a river of knowledge. Keep it flowing man!

regards.

@ sujatha

caution on time targets , i cant calculate when the rally ends ,just trade the prices with caution and keep discipline.rest will follow.

best wishes

@ rm

Hope this dip in knowledge river washes our 'sins' . amen !!

a lot of times on jn blog and on cnbc to it is talked about inverse corelation with dollar index for all emerging market equities and commodities. dollar index is falling against euro as usd against inr.u have presented it very nicely. i have no idea abt the cause and effect.

u r the true shishya of ilango sir and i aspire to get some such qualities -)

Post a Comment